Leasing a forklift rather than purchasing one outright can offer a range of benefits, from financial flexibility to easy access to the latest models. However, navigating the leasing process can be overwhelming, especially with various types of leases, terms, and conditions to consider.

That’s why we’ve put together this comprehensive guide to forklift leasing. Whether you’re a small business owner or a logistics manager of a large corporation, this guide will provide you with the knowledge and tools you need to make the most informed decision about forklift leasing. So let’s delve into the world of forklift leasing and uncover how it could benefit your business operations.

Not sure where to start with buying a forklift? Check out our comprehensive Forklift Buyer’s Guide >

What Is Forklift Leasing?

In simple terms forklift leasing is a financial agreement between a business and a leasing company where the business gets to use a forklift for a specified period without owning it outright.

Just like leasing a car, a forklift lease allows businesses to utilise this essential piece of equipment for their operations while making regular payments. These payments are typically lower than what you would pay if you were buying the forklift outright.

At the end of the lease term, the business has the option to return the forklift, extend the lease, or sometimes purchase the forklift at a reduced price. This arrangement provides businesses with financial flexibility, access to the latest forklift models, and the ability to easily upgrade or replace equipment as needs change.

How Does Forklift Leasing Work?

Forklift leasing works through a contract between a business and a leasing company. The leasing company purchases the forklift and then rents it out to the business for a set period, which can range from a few months to several years.

The business makes regular payments throughout the lease term, typically on a monthly basis. These payments are determined by factors such as the cost of the forklift, the length of the lease, and the estimated residual value of the forklift at the end of the lease.

At the onset of the lease, the business and the leasing company agree on the terms, including how the forklift will be used, who will be responsible for maintenance and repairs, and what options will be available at the end of the lease.

Throughout the lease term, the forklift remains the property of the leasing company, allowing the business to free up capital that would otherwise be tied up in owning the equipment.

How Much Does It Cost to Lease a Forklift?

The forklift lease cost depends on several factors, including lease type, the specific model, its capacity, the duration of the lease, and the machine’s condition.

As a rough guide a standard forklift with a capacity between 1,000 to 2,000 kilograms, you can expect to pay £200 to £500 per month on a five-year lease. If you are looking at high-capacity or specialised forklifts, these could cost £800 or more per month.

Remember, these costs often include maintenance and repairs, which can provide potential long-term savings.

Types of Forklift Leases

There are primarily four types of forklift leases that businesses can choose from: Operating leases, Capital Lease, Prepaid Lease and Flexi Lease. Let’s take a look at each types unique features and benefits:

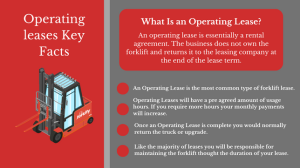

Operating leases

Also known as a fair market value lease, an operating lease is essentially a rental agreement. The business does not own the forklift and returns it to the leasing company at the end of the lease term. This option typically has lower monthly payments and offers businesses the flexibility to upgrade to newer models easily.

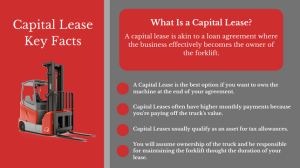

Capital Lease

Also known as a finance lease in the UK, a capital lease is akin to a loan agreement where the business effectively becomes the owner of the forklift.

Under this arrangement, the leasing company purchases the equipment and then leases it to the business for a set period. Monthly payments are typically higher compared to other lease types, but at the end of the lease term, the business has the option to purchase the forklift for a nominal fee, often just £1.

This type of lease is usually treated as an asset on the company’s balance sheet, making it eligible for tax allowances such as the Annual Investment Allowance (AIA). As of 2023, businesses can claim up to £1 million in AIA for capital equipment purchases, according to the UK government’s guidelines.

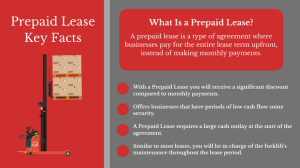

Prepaid Lease

A prepaid lease is a type of agreement where businesses pay for the entire lease term upfront, instead of making monthly payments. This can be particularly advantageous for businesses with high seasonal cash flow.

By aligning the pre-payment with a period of high revenue, businesses can effectively manage their cash flow and avoid monthly lease payments during leaner months.

Moreover, leasing companies often offer significant discounts for prepayment, resulting in overall cost savings.

However, it’s worth noting that this type of lease requires a substantial initial cash outlay, so it’s important for businesses to ensure they have sufficient reserves to comfortably make the prepayment.

Flexi Lease

A flexi lease offers the utmost flexibility, allowing businesses to increase or decrease their lease term or adjust their monthly payment amount as their needs change.

This type of lease is perfect for businesses with fluctuating workloads or those that are rapidly growing or downsizing. However, this flexibility comes at a cost.

The overall lease payments under a flexi lease might be higher compared to more standard lease options, as leasing companies often charge a premium for the ability to adapt the lease terms.

Therefore, while a flexi lease can provide valuable adaptability, it’s important for businesses to assess whether the additional cost aligns with their financial strategy and operational needs.

In conclusion, while various leasing options offer unique benefits depending on your business needs, it’s crucial to remember that not all finance providers offer all types of leases, so thorough research and consultation with potential providers is essential.

Leasing vs Buying: A Comparison

When it comes to acquiring equipment for your business, the decision between leasing and purchase can be complex. Each approach has its own set of benefits and drawbacks, and these must be carefully considered in relation to your business’s specific needs, financial situation, and long-term goals.

- Upfront Costs: Leasing usually requires less upfront capital compared to buying. While buying requires a significant initial investment, leasing often involves just the first and last month’s payments upfront.

- Cash Flow Management: Leasing can be beneficial for businesses looking to manage their cash flow more effectively. The predictable monthly payments associated with leases can make budgeting easier.

- Ownership: When you buy equipment, you own it outright and can use it for as long as you deem fit. In contrast, a lease gives you the right to use the equipment for a specific period, after which you can choose to purchase, return, or renew the lease.

- Tax Implications: Lease payments can often be deducted as business expenses, potentially leading to tax savings. On the other hand, purchased equipment is typically considered a capital expense and can be depreciated over time.

- Maintenance and Upgrades: Leased equipment often includes maintenance in the contract, and upgrading to new technology can be easier and less costly. With purchased equipment, the owner is responsible for maintenance, and upgrades may require another significant investment.

- Flexibility: Leasing offers more flexibility as it allows businesses to stay updated with the latest equipment without making a substantial financial commitment. However, buying might be a better option if the equipment has a long lifespan and doesn’t become obsolete quickly.

Remember, the best choice depends on your specific business situation and goals. It’s always a good idea to consult with a financial advisor to understand the implications of both options fully.

Advantages and Disadvantages Of Leasing a Forklift

When considering whether to lease a forklift for your business operations, it’s crucial to understand the potential advantages and disadvantages.

Advantages

- Lower Upfront Costs: Leasing a forklift often requires less upfront capital than purchasing one outright. This can be beneficial for businesses looking to conserve cash or those with tight budgets.

- Predictable Expenses: Leasing contracts usually come with fixed monthly payments, making it easier for businesses to budget and manage their cash flow.

- Access to Latest Technology: Leasing agreements often make it easier for businesses to upgrade to newer models or technology, ensuring they always have access to the most efficient and effective equipment.

- Maintenance and Repairs: Many leasing contracts include provisions for maintenance and repairs, which can save businesses both time and money.

- Flexibility: At the end of the lease term, businesses have the flexibility to return, upgrade, or purchase the equipment depending on their needs at that time.

Disadvantages

- Ownership: One of the main disadvantages of traditional leasing is that you usually don’t own the equipment. If you plan on using the forklift for a long period, buying or a lease to own agreement might be more cost-effective.

- Long-term Cost: While leasing has lower upfront costs, the total cost over the duration of the lease term can end up being higher than the purchase price of the equipment.

- Contractual Obligations: Leases come with contractual obligations. Failure to uphold these, such as returning the equipment in good condition or adhering to usage limits, could result in additional charges.

- Limited Customization: Leased equipment may not offer the same level of customization that purchased equipment does, as any modifications must typically be approved by the lessor.

Where Can I Lease a Forklift In The UK?

When you’re looking to lease a forklift in the UK, there are several avenues you can explore:

- Manufacturers: Many forklift manufacturers offer leasing options directly. These programs often include benefits like maintenance packages and the option to upgrade to newer models.

- Independent Leasing Companies: These companies specialise in equipment leasing and offer a wide range of options. They provide flexible finance and leasing options for both new and used forklifts.

- Banks and Financial Institutions: Some banks and financial institutions also offer equipment leasing services. They have commercial equipment financing divisions that may include forklift leasing.

- Rental Companies: Rental companies offer both short-term and long-term forklift rentals, which can be a good option for businesses with temporary needs.

Remember, each provider will have different terms and conditions, so it’s important to thoroughly review any lease agreement before signing. It’s also a good idea to compare quotes from multiple providers to ensure you’re getting the best deal possible.

Forkify makes it easy to get quotes from forklift dealers in your area simply enter a few details on our homepage and await your quotes!

Key Questions To Ask If You Plan To Lease

If you’re planning to lease a forklift, it’s important to ask the right questions to ensure you’re making a sound decision. Here are some key questions you should consider:

- What is the total cost of the lease? Make sure to understand all the forklift lease costs, including monthly payments, any upfront fees, and potential end-of-lease charges.

- What is the lease term? The length of the lease can impact the monthly payment and your ability to upgrade or return the equipment.

- What is included in the lease agreement? Some leases may include maintenance and repairs, while others may not. It’s important to know what services and benefits are included.

- Can I upgrade the equipment during the lease term? Depending on the length of your lease and the nature of your business, you may want the flexibility to upgrade to newer models as they become available.

- What happens at the end of the lease? Understand whether you have the option to purchase the equipment at the end of the lease, and if so, at what price. Also, check what the terms are for returning the equipment.

- How flexible is the lease? Check if there are provisions for changing your needs mid-term, such as acquiring additional equipment or returning equipment early.

- What’s the procedure for service and repair? Knowing who is responsible for maintaining and repairing the equipment—and how quickly they respond to issues—can save you significant time and money.

Remember, the more informed you are, the better positioned you’ll be to negotiate a lease that meets your business needs.

Final Thoughts

Leasing a forklift can be an excellent choice for many businesses. It provides access to top-tier equipment without the large upfront costs of purchasing outright, and it often includes warranty and the flexibility to upgrade as needed.

However, as with any significant business decision, it’s important to ask the right questions and understand the terms of your lease agreement fully. By doing your due diligence and comparing offers from different providers, you can find a leasing solution that aligns perfectly with your business needs and budget.

Ultimately, a well-chosen lease can be a strategic tool for enhancing productivity and efficiency in your operations.